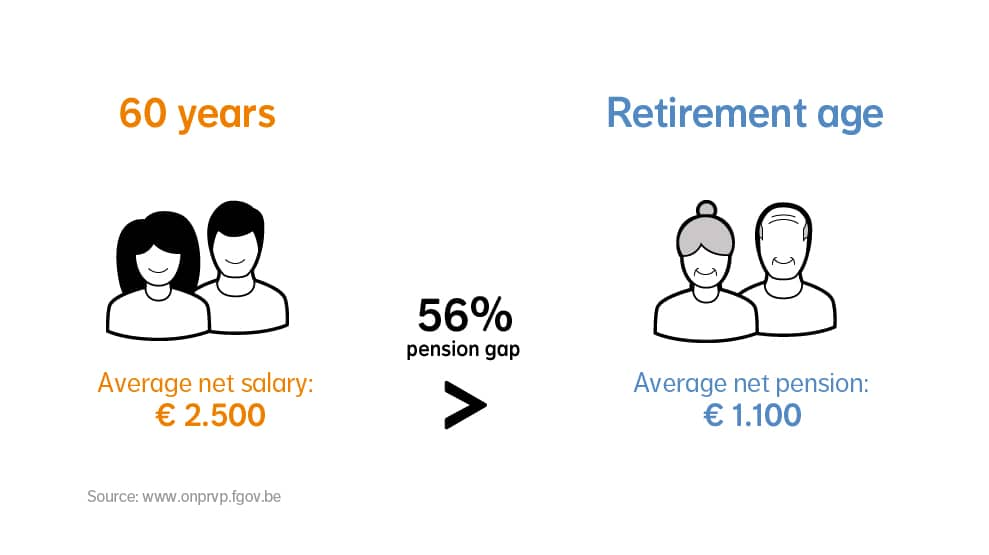

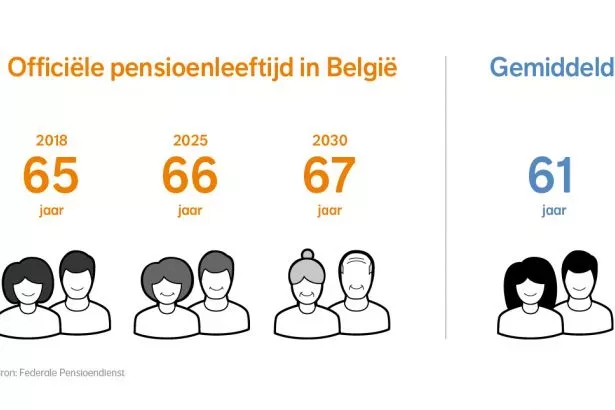

Will you be able to make ends meet with your statutory pension for the self-employed?

The answer is simple: no. Because the pension you’ll get from the government is (a lot) lower than your current income. So it won’t be enough for you to maintain your lifestyle. But how wide will the gap be in your case? Start by asking yourself how much your statutory pension will be and how much you think you’ll need. Only then can you begin to prepare... in your own personal way!

How do you go about building a supplementary pension?

Anyone dreaming of a long and happy life would do best to have a supplementary pension. There are plenty of options, too: a Free Supplementary Pension for the Self-Employed (VAPZ), an Individual Pension Commitment (IPT), a Pension Agreement for the Self-Employed (POZ) or a Group Insurance policy for company directors. There are also various ways of ‘saving for retirement’, such as a life insurance policy.

NN’s solutions for your pension

VAPZ: the foundation for every self-employed person’s pension

With a Free Supplementary Pension for the Self-Employed (VAPZ), you’ll save a nice sum of money for later. At the same time, you’ll also benefit from tax and social security advantages: up to 60% of your premium.

IPT: the pension for the self-employed who have a business

Your Individual Pension Commitment (IPT) means you save a fixed amount each month via your company. The money’s fiscally attractive and dynamically invested with potentially high returns.

POZ: the pension for the self-employed without a business

Your Pension Agreement for the Self-Employed enables you to benefit from a tax reduction of 30% when saving through your personal income tax. Dynamically invested with potentially high returns.

Calculate your supplementary pension

How much do you need on top of your statutory pension to be financial secure? Calculate the amount yourself on mypension.be or via our simulator.

Calculate your pension

Find a broker near you

Want more information about death cover?

Got another question? Find an independent broker near you.